Americans who were concerned about government education loan payments resuming inside Oct averted sweating immediately following President Joe Biden’s management made a decision to stretch the fresh new freeze towards payments and you will appeal to have an additional four months.

That implies the fresh new around 42 mil government student loan individuals is off of the hook up up to . Biden’s Institution regarding Knowledge cautioned that this was brand new “final expansion” away from a stop toward beginner debt that has been positioned https://elitecashadvance.com/loans/loans-for-gig-workers/ as .

When you yourself have college loans and your profit have held up pretty well into the pandemic, benefit from this type of history months of your moratorium to clear out as often of that loans as you’re able.

1. Generate payments, even although you don’t need to

While it would be tempting to remain “toward break” out of your college loans up until February, continued their regular repayments – as well as expenses more than the common lowest – is a sensible suggestion, if you can manage they.

Given that rates of interest toward federal college loans are frozen on 0%, any money you will be making today will go entirely into the the principal of one’s loan.

Meaning you happen to be in a position to get a good amount from the loan harmony. Whenever education loan financial obligation are suspended a year ago, the average balance is $20,one hundred thousand so you can $twenty four,999, according to Government Reserve investigation.

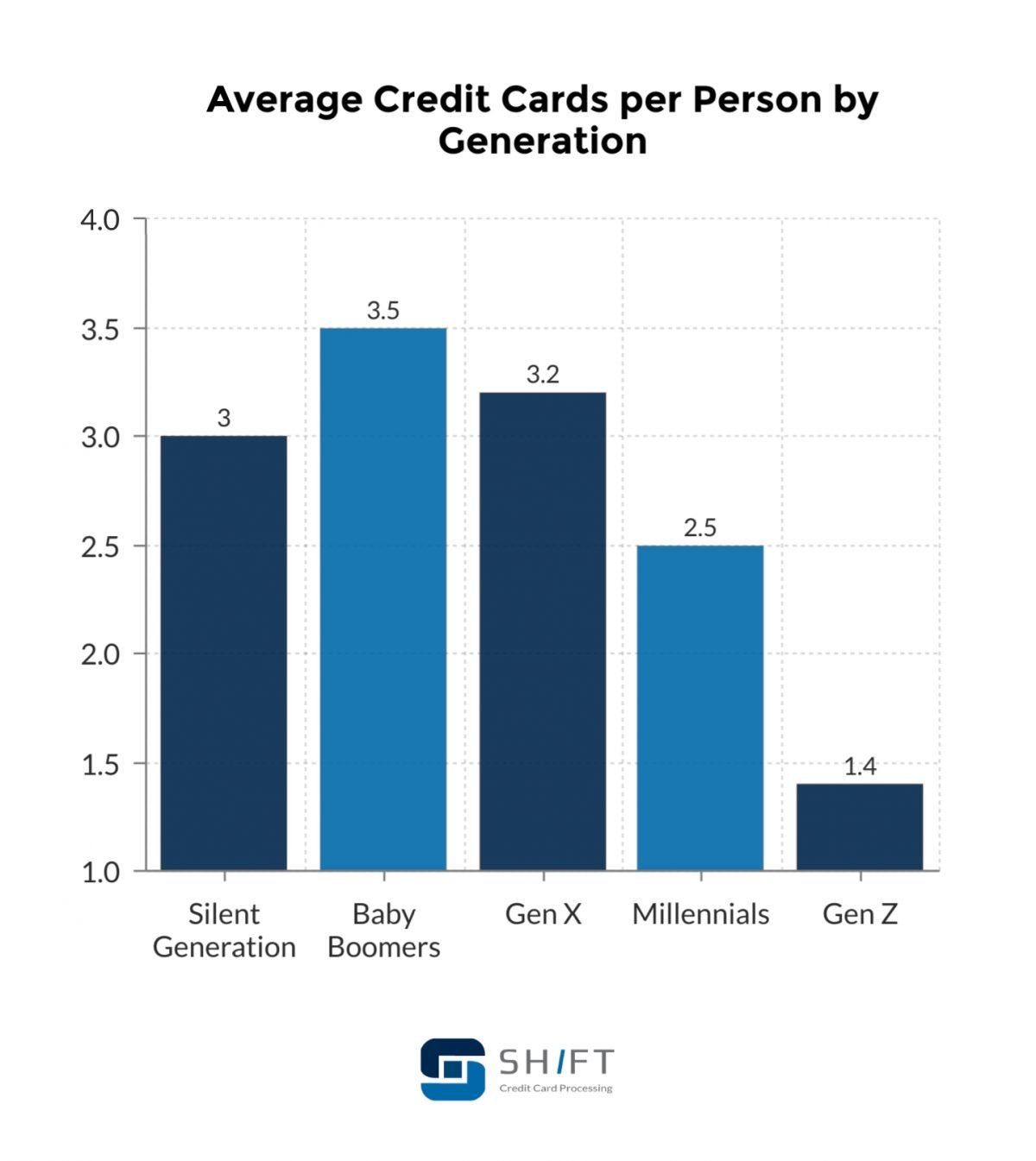

Resuming your repayments very early could be impossible in the event that you might be dealing with most other expenses, such as for example if you ran your credit cards during the an occasion regarding jobless last year. You.S. Education Assistant Miguel Cardona mentioned in the a job interview a week ago you to definitely authorities is looking for alternative methods to help relieve the duty on the student loan individuals, in this new interim, you age those people expenses with the help of a lesser-notice debt consolidation reduction loan.

2. Search another type of fees plan

You could potentially clear your own education loan obligations quicker from the altering up your existing fee package, especially if the pandemic cut your income also it still hasn’t return.

The federal government now offers income-passionate installment agreements that enable borrowers and make economical payments, centered on what they earn. Once you create 20 or 25 years from regular payments below a living-driven plan, their left obligations could well be forgiven.

That would be your absolute best decide to try in the that have a number of your figuratively speaking canceled. Chairman Biden campaigned toward wiping out $10,100 within the scholar obligations each debtor, and top Democrats is actually pressing your to visit $fifty,100 – however, discover issues today more whether Biden comes with the authority to forgive enormous pupil personal debt.

One easy money-rescuing step which have a federal student loan is to try to subscribe autopay since signing up for automated dumps often be considered you to own an effective 0.25% rate of interest prevention whenever costs restart.

step 3. Refinance private money

In case your figuratively speaking are from an exclusive financial rather than the federal government, brand new lengthened payments stop will not connect with your. But you can assault their scholar obligations along side 2nd few days by refinancing the loan since the interest rates towards refi college student financing regarding personal lenders was basically at the over the years lower levels.

If or not your qualify for refinancing usually mostly believe their credit score along with your most recent earnings. If you aren’t yes regarding your score, it’s easy to check your credit score free-of-charge on the web.

Even though you have missing your job because of the pandemic, you may be eligible for an effective refi if you can tell you capital money otherwise income regarding a part gig, or find an effective co-signer so you can straight back the job. For the right rate to refinance a student loan, you’ll want to look around and you may evaluate estimates away from several lenders.

Remember you to definitely refinancing isnt a choice if you a national student loan, and you will replacing a federal financing that have a private one to makes you ineligible for all the next mortgage relief measures regarding authorities.

This particular article brings guidance only and should not become construed while the information. Its offered versus guarantee of any kind.