Jumbo loans courtesy BECU are supplied as the each other repaired- and you can variable-price finance and you can afford individuals the ability to loans home one to become more pricey than simply a traditional purchase.

New Federal Construction Money Agency set minimal jumbo loan amount during the $453,100, regardless if it a bit highest in a few says having ft expensive a house can cost you. Customers looking highest-worthy of services go for an effective fifteen- or 31-year fixed jumbo mortgage or for 5/5, 5/step 1, step 10/step one, or seven/step 1 Palms.

Since identity implies, that it mortgage was aimed toward very first-date homebuyers and you can, from First-go out Family Customer Offer Program, financing is going to be repaired, old-fashioned otherwise 5/5 Sleeve.

Some other $six,five-hundred is generally granted because of the BECU to help finance a lower percentage, and consumers take advantage of devoid of to spend origination charges. The appearance of that it loan causes it to be best for young consumers struggling to manage upfront down money, who can benefit specifically away from more realtor service.

BECU Va finance

Virtual assistant money promote certified veterans, reservists, active-obligation servicemen and you will lady, and you may qualified family relations with resource in the way of repaired- or variable-rate mortgages that have low or no downpayment alternatives.

Individual mortgage insurance is not required, and you will settlement costs and charge is actually restricted. Experts can use its Virtual assistant Certificate out of Eligibility (COE) due to a good BECU Virtual assistant financing, and versatile borrowing certification recommendations enable it to be more relaxing for borrowers which have suboptimal credit ratings.

BECU build funds

Individuals building house on their own can benefit off BECU’s interest-just terms and conditions in the framework phase. Given that residence is finished, financial terms convert to a permanent mortgage without having to file extra documentation or shell out most fees.

Consumers exactly who hire top-notch designers are able to use BECU’s Hired Creator program, where mortgage loans may be built to account fully for around 80% regarding loan-to-order will set you back, or perhaps the appraised worth of the new so you’re able to-be-founded home.

BECU HELOC

Domestic security line of credit (HELOC) funds allow consumers to gain access to and you may power the existing collateral into the their houses for several financial obligations such as merging debt, and also make a significant do-it-yourself, or to acquire almost every other considerable property. Owing to BECU, HELOCs are provided and no charges to own origination, assessment, term insurance, pre-percentage penalty, escrow, and you will file emailing.

Designed as an unbarred-prevent mortgage, people is also always borrow on the equity because they go, in the place of taking out fully an individual share initial. To possess borrowing from the bank relationship players that are uncertain exactly what the eventual endeavor costs can be otherwise that have numerous assets that require resource, a great HELOC will be preferable.

BECU Home loan Buyers Feel

BECU also provides a host of easy-to-find affiliate info while in the their website. Plus financial calculators, an indigenous Inquire a question search club, and you will beneficial weblog stuff dedicated to all their first qualities, new economic institution’s BECU & You webpage is stuffed with entertaining tips such as infographics, webinars, self-paced courses, and you may instructional books. Moms and dads may also make use of these to activate kids which have financial-literacy tips.

BECU plus conveniently provides procedures with which for connecting with financial advisers inside a far more individualized means. Some of those software ‘s the 100 % free Financial Health check, which is a-one-on-you to, real-date session which have a specialist whom helps people exercise on cost management, coupons, using, and you can loans government. Appointments usually last anywhere between forty-50 times.

Free class room demonstrations are also available to help you Western Washington owners and you may is provided from the BECU financial coaches. Kinds shall be tailored to help you highschool, college or university, otherwise adult audience, which have topics anywhere between chance administration and borrowing so you’re able to cost management and you will first-go out homeownership.

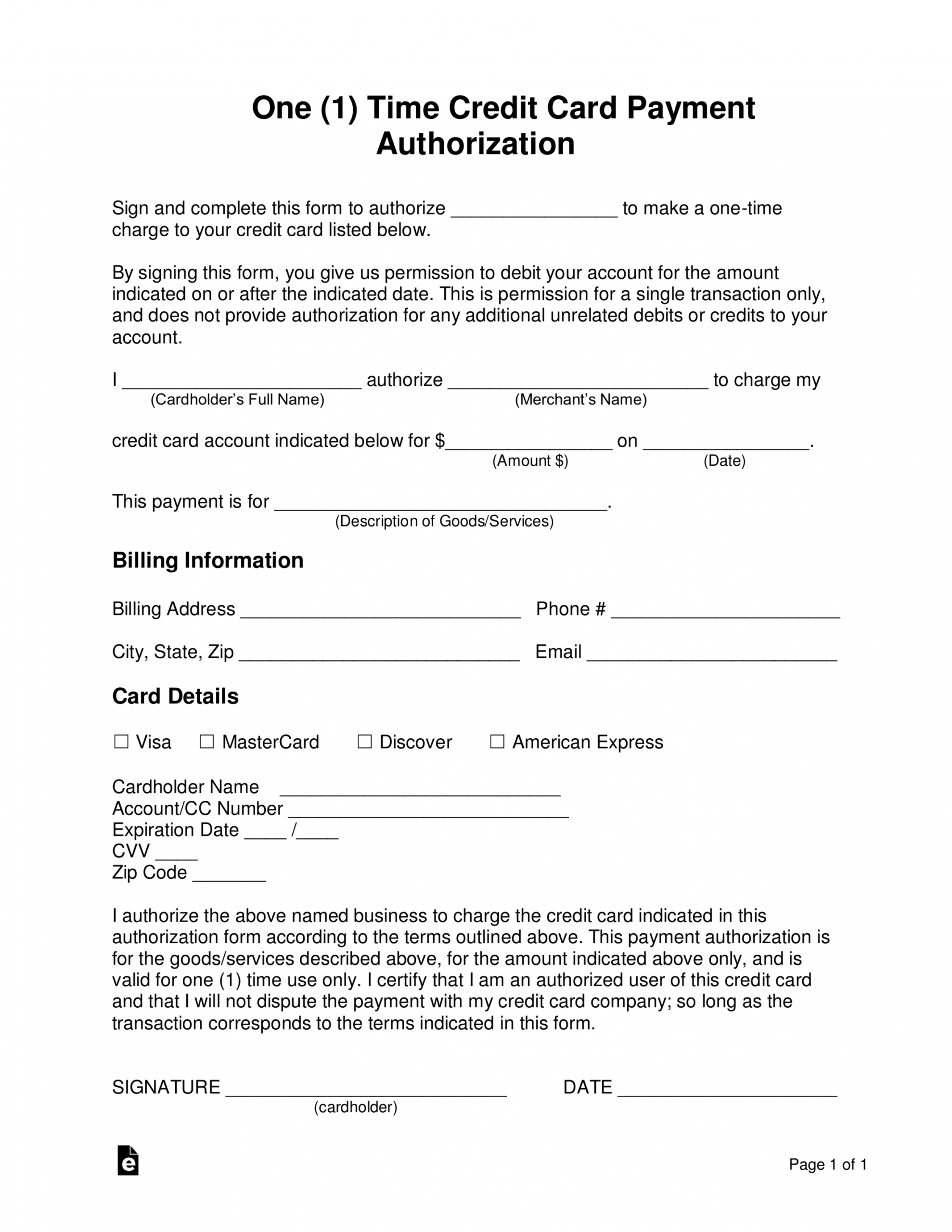

These affiliate-centric services match user-friendly fulfilling-reservation provides and simple on line software. Consumers personal loan covid obtaining home loans on the web need certainly to sign Elizabeth-consent variations and be available to the procedure when deciding to take about 20 minutes. An example record off factors wanted to incorporate online were: