A property equity financing is a type of protected loan in which a borrower uses the latest guarantee of the household as guarantee for the lending company. The quantity offered is influenced by the worth of brand new possessions due to the fact influenced by a keen appraiser regarding the financial. Obtaining one ones funds mode your house has actually a good lien involved plus genuine collateral yourself was smaller. Credit up against the equity of your home are an effective way of getting the lowest-cost loan. There’s two variety of house equity loans: house collateral lines of credit (HELOCs) and you will fixed-rates finance. Each one of these keeps the pros and cons, so be sure to opt for the one that’s ideal aimed with your circumstances. Assuming you need certain give-into suggestions, consider hiring the assistance of a trusted monetary coach.

Domestic Security Fund Definition

A home equity loan, sometimes described as a beneficial 2nd financial, has the benefit of a method getting home owners so you can acquire according to research by the guarantee it hold in their residence. To put it differently, you might borrow funds based on the difference between the current balance of one’s financial plus house’s newest really worth. The newest collateral you own of your property is short for your equity.

- House equity credit line (HELOC): An effective HELOC lets people borrow money while they you would like. Speaking of always variable-price fund, nonetheless hold a certain label duration. Once the label is done, you need to pay off exactly what you borrowed.

- Fixed-rate domestic collateral loan: Like a basic mortgage, it repaired-speed loan provides you with one lump sum. As the name suggests, you will have to make normal payments from the an appartment interest rate for a specific name.

Home Collateral Mortgage and you can HELOC Professionals

Instead of signature loans (including an unsecured loan) or lines of credit (such as for example a credit card), you will employ your home due to the fact guarantee. This will be true out of one another a property security financing and you will a good HELOC. It indicates it will be easier in order to qualify for your loan considering your own kept financial worth was below their residence’s value.

Besides, household equity money has actually very lax standards. Household guarantee finance commonly require the citizen getting within minimum fifteen% security in their home. In terms of credit ratings are worried, a get of at least 620 can often be enough having acceptance. Your debt-to-earnings (DTI) ratio should be no more 50%.

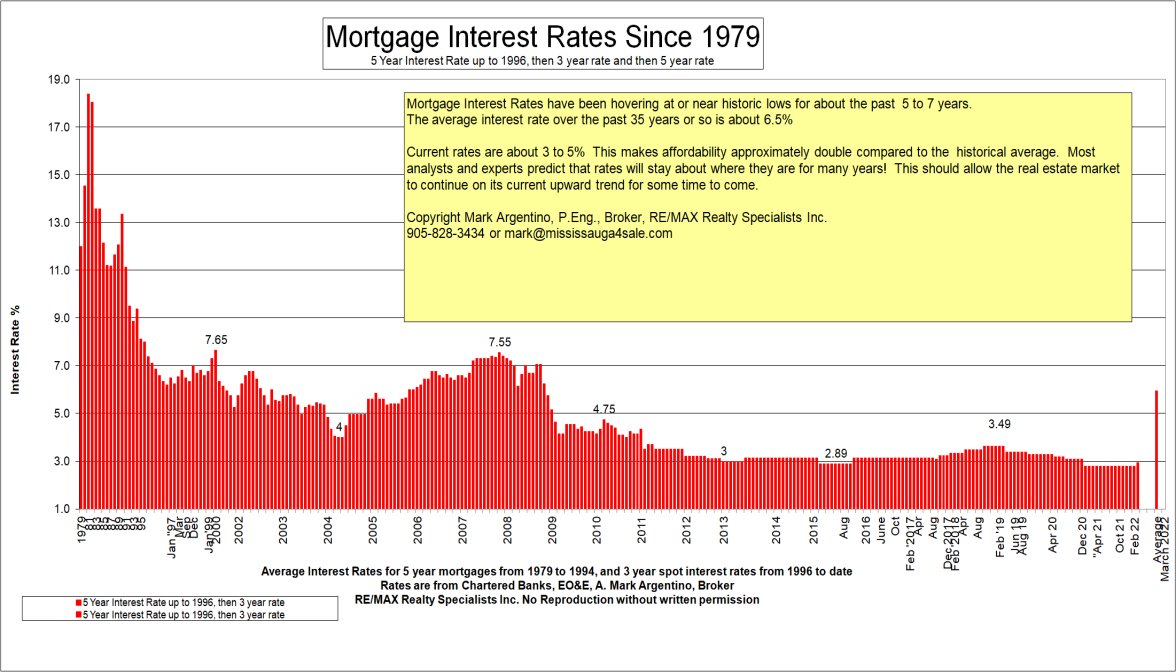

You’ll also rating lower rates of interest with a house collateral loan than just almost every other equivalent alternatives. According to ValuePenguin’s 2019 report, the typical rates on the 15-12 months fixed-rates house collateral mortgage try 5.76%. For an effective HELOC, its 5.51%. Bear in mind that a HELOC normally offers a variable speed, definition the rate can change because sector costs change.

Past that it, household guarantee loans constantly let you acquire quite a bit of currency. Indeed, capable diversity from $10,000 doing thousands of bucks. You may use them for any purpose. Borrowers are able to use the money to own household home improvements, paying down highest-attract fund, spending money on university and you may starting a business.

With a property guarantee mortgage, what kind of cash you could borrow is specific and place from inside the stone. But when you choose a HELOC, you’ll have a lot more liberty. The reason being you might pull out around you need, when it’s needed, up to the latest restriction of the HELOC. Your repayments vary too.

House Collateral Loan and HELOC Drawbacks

The major risk having property guarantee mortgage or HELOC is actually that you might clean out your house or even spend they straight back. The point of a secured loan, whatsoever, is that loan providers be more happy to give for you since they know capable bring your equity if not spend. In such a case, the guarantee is the home. Cannot risk the new roof more than your head to have a minimal-cost loan when you yourself have any doubt about your power to pay it off.