Inside a world of ascending household prices, low-to-moderate earnings earners might still be able to end up being people, despite a modest deposit otherwise a limited credit score. Solutions may exist getting homeowners which have modest revenue thanks to programs off towns, nonprofit organizations, and financial institutions.

These examples, according to research by the feel from normal homebuyers having lowest-to-modest earnings, story more routes to help you homeownership in the place of higher off payments otherwise prime credit ratings.

Sarah: Just starting

Sarah only landed the girl basic elite group occupations. She actually is prepared to become a resident because the she’s got a stable field, intentions to are now living in your house for the near future, and has enough currency getting a small advance payment into a great household.

- Lower step 3% deposit towards the a traditional, fixed-rate home loan

- Tends to be superimposed that have gives and you may credits to greatly help qualified buyers having downpayment and you may settlement costs

- Independence to possess buyers having a finite credit score otherwise a smaller-than-perfect credit score.

Keep in mind that home loan insurance policies are needed, which boosts the price of the loan and can enhance your monthly payment. We will explain the solutions, in order to favor that which works to you.

Talk to a mortgage loan associate on loan amount, mortgage type of, possessions type of, income, first-date homebuyer, and you will homebuyer training to decide qualification.

Beth: More compact homeownership fantasies

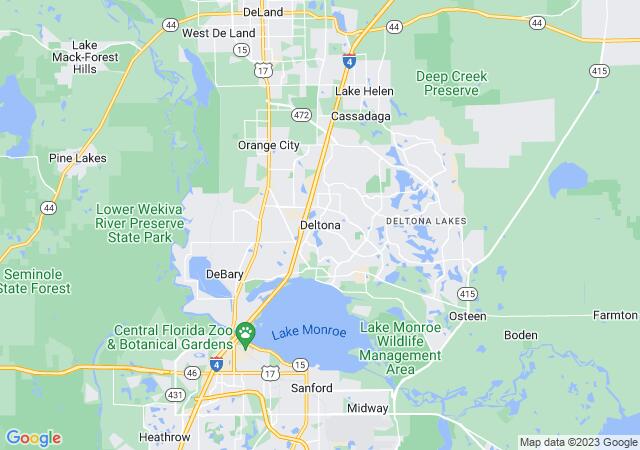

Beth lifestyle near a small area in the country together spouse and you will little boy. Its money is actually regular however, more compact, allowing them to manage monthly property repayments however rescue far. Beth is actually renting a home today and has always wanted to be a citizen, however, cannot see her selection.

Beth’s relatives, like other low-to-average earnings consumers inside rural components, are qualified to receive financing from the Guaranteed Outlying Property System administered loans Cannondale CT because of the You.S. Department from Agriculture (USDA) Rural Development. These loans feature:

- Investment of up to 100% with no called for down payment

- Long-term repaired-rate words, helping to continue prominent and you can notice money foreseeable along side lives of your own loan

- The capacity to funds settlement costs, the latest be sure fee, courtroom charge, and other prepaid service fees

Borrowers pays a-one-day make sure percentage and you will an annual commission into the USDA’s Rural Creativity program. Brand new monthly mortgage repayment should include the latest yearly payment, and will range from the verify commission. These charge increase the price of the mortgage and month-to-month payments.

Rick: Interested in a home for his loved ones

Rick are an energetic-obligations services affiliate just who recently is back out-of a long journey to another country. The guy and his spouse dream of raising the one or two youngsters for the property of their own.

Rick along with his girlfriend could be eligible to get its very first house with a part off Veterans Situations (VA) loan. Experts and you will factors of using this method are:

- Because the Va loans render lower- without-down-payment possibilities, Rick and his partner can be reserve part of the savings to have household repairs and you may unforeseen expenditures.

- Rick is able to receive a give throughout the government to utilize into the closing costs.

- Since Va loans do not require monthly home loan insurance coverage, Rick and his awesome partner have a tendency to alternatively pay a single-big date Va funding commission (a portion of one’s amount borrowed according to particular financing, military class, first-some time previous access to entitlement, and you will deposit amount).

To-be a successful resident

To allow you to a successful citizen, think hard towards decision to find, to make sure that homeownership suits your personal and you can financial situation. To invest in a home relates to even more than protecting financing and you will and come up with monthly installments.

When you find yourself happy to get a house however the scenarios chatted about a lot more than try not to echo the, remember that you may still be eligible for get with assistance from their area, condition, or state. Wells Fargo also has multiple apps to create homeownership an excellent likelihood of of a lot reasonable-to-average income homebuyers.

Encourage yourself with monetary knowledge

We are invested in letting you since you really works into economic achievement. Right here you’ll find numerous techniques, interactive gadgets, practical actions, and a lot more – the built to enhance your financial literacy and help you are able to your financial specifications.