For some home buyers inside the Nj, the fresh new down-payment signifies the fresh new single most significant obstacle so you’re able to homeownership. However in some instances, it is simply an imagined obstacle. The truth is the present down-payment standards for brand new Jersey financial finance try less than most people read. Here is what you must know about it, as the a property buyer.

A great 2016 survey used by the National Relationship out of Real estate professionals unearthed that 66% of individuals consider it necessary over 20% having an advance payment into the property. That is a common misconception.

The thing is consumers dont fundamentally you desire a down-payment out of 20% to shop for a home. The typical down-payment one of New jersey home buyers are somewhere around 10%, there was financial support options available now that allow to possess an also quicker deposit. However, many people are not aware this.

Mortgage brokers Having Lower Financial support Criteria

Can’t built 20% when purchasing a house into the Nj-new jersey? You have still got choice. Below are a few examples of funding steps having less off payment criteria.

- Old-fashioned loans that have step three%: Federal national mortgage association and you can Freddie Mac, the 2 regulators-sponsored companies you to definitely buy mortgages from loan providers, each other offer programs having around 97% money. Consequently qualified individuals could potentially pick a house inside the Nj that have as little as step 3% off, using a conventional financial unit.

- FHA fund having 3.5%: The latest Federal Construction Administration’s home Alabama personal loans for bad credit loan system lets qualified individuals to help you generate a downpayment as little as 3.5% of your cost or appraised value. Which financial system is specially preferred one of New jersey homebuyers whom do not have the money having a much bigger advance payment, which has of a lot first-date customers.

- Va fund that have 0%: Whenever you are a military representative otherwise experienced, and you are probably buy a house in the New jersey, you will want to you should think about the latest Institution regarding Pros Circumstances (VA) financing program. By this program, borrowers can obtain 100% resource, which eliminates significance of a down-payment altogether. It’s hard to conquer.

As you can see, you can find an approach to stop an excellent 20% down-payment towards property in the New jersey. Provided, you can find times when a larger money is requisite. This can be possibly possible having jumbofinancial products which exceed the mortgage limitations where the house is getting bought. But for the typical house customer inside Nj, you’ll find low-down fee financial possibilities.

Predicated on a report wrote early in 2017, an average downpayment during the Nj-new jersey and you can nationwide try 11%. This is based on a diagnosis off financial information out of home financing credit app company.

This underscores the notion one Nj home buyers do not constantly have to lay 20% off when purchasing property. And yet many users accept that this new 20% advance payment was required throughout pick conditions. It’s a familiar misconception we are trying to dismiss as a result of our running a blog services.

A number of the mortgage circumstances on the market today accommodate advance payment gift ideas from businesses. This is how your house buyer receives money from children representative (and other approved donor) to assist protection this new down payment bills toward a property.

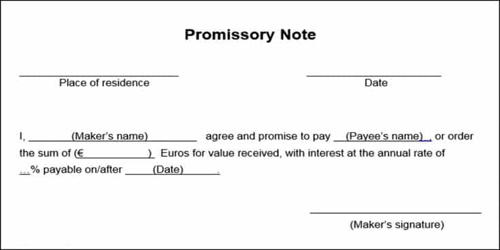

While the laws and needs differ, of several conventional and you can regulators-supported financial programs accommodate this type of presents. The brand new caveat is that the person providing the financing must offer a letter proclaiming that they don’t expect any kind regarding repayment. It should be a gift – perhaps not a loan.

The bottom line to all or any this might be the mortgage financing marketplace is way more flexible than most people read. This is especially true when it comes to down-payment criteria within the Nj-new jersey. Because of the consolidating a decreased down-payment loan that have financial assistance away from a relative and other accepted donor, home buyers can also be greatly reduce their initial away-of-pouch expenses.

Financial down-payment

Why don’t we discuss your options. Nj Loan providers Corp. also offers a number of financial items having consumers over the condition of brand new Jersey. Delight e mail us if you want to explore their financing selection, or if you has actually questions regarding the brand new advance payment conditions when to acquire a home during the Nj-new jersey.