A year ago are an appealing seasons; into COVID-19 pandemic additionally the presidential election, that which you appeared somewhat different. However, perhaps not everything that happened last year try bad, to your past season taking particular significant condition to Va household money, with while the somewhat increased the usage. Considering latest research, making use of Va funds enhanced from the 11.4% regarding 2019 so you’re able to 2020, bringing a maximum of over 1.dos million financing secured in a single year on account of these alter.

Closed on the laws towards the , of the U.S. Chairman, the newest Bluewater Navy Work has brought specific significant alter into the Va financing program. The new White Home introduced the fresh operate looking to make up Vietnam Battle Veterans which had exposed to harmful chemicals during their deployment. Regulations along with changed several extreme elements of the fresh Virtual assistant mortgage system by switching the latest Va mortgage capital commission and VA’s loan limits.

Changes towards the Financing Fee

Brand new Virtual assistant financing commission, a one-big date payment one Virtual assistant loan people have to pay on the financing, are temporarily changed. The change managed to make it so as that Active Responsibility Service Members spend an increased funding fee out of 0.30%, which before is at 0.15%. Members of the new Federal Protect and you will members of the supplies, in addition, are actually paying a lesser count on the financing fees. However, these types of transform try short-term and so are said to continue for in the minimum another two years.

Effective Obligation Provider Users that a purple heart might have the funding payment got rid of when they close their house while in a working-obligation reputation. And, pros having handicaps have been currently excused regarding make payment on financial support fee did not find any changes to their financial support fee fee standards.

Removal of the fresh Va Mortgage Restrict In earlier times, individuals who applied for an effective Virtual assistant financing had to deal with Va condition loan limits, hence ranged for every state. Which is no more possible due to the fact Va completely removed these types of mortgage limitation standards to possess first-date Va mortgage consumers. Hence, Virtual assistant financial readers currently have the ability to live-in even more rich organizations, before unaffordable as a result of the Virtual assistant loan restrictions.

People just who already have an excellent Va financing and want to grab away an additional one to remain susceptible to their county Va loan limitation, hence an average of, by 2021, features a limit from $548,250, that will will vary for every single condition.

It is vital to note that whilst the loan restriction elimination allows loan providers in order to provide aside far more, it doesn’t mean that lenders would not restrict simply how much your can also be acquire. Given that financing are given out by lenders rather than the fresh Va, around can nevertheless be limitations in for navigate to website exactly how much you could potentially borrow. Currently, Virtual assistant Financial Centers has actually a loan maximum away from $5,000,000 to possess earliest-go out Virtual assistant financing borrowers.

Indigenous Western Veterans just who get a great Va financial and you can want to get a home for the Government Trust House no longer experience mortgage limitation conditions.

What is an effective Va Home loan?

Have a tendency to promoted as one of the better government-guaranteed lenders offered, Virtual assistant mortgage brokers provide multiple tall experts. They’ve been no down-payment criteria, no home loan premiums, low-rates, low monthly payments, and fixed mortgage loans, and this last between 15 to three decades.

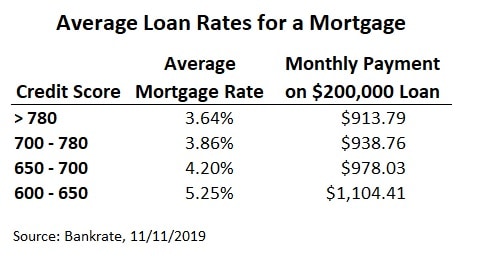

Also, the fresh new U.S. Bodies pledges these types of loans, giving loan providers coverage if consumers cannot afford and then make its monthly mortgage payments and become defaulting. And therefore, lenders much more easy the help of its software criteria consequently they are happy to work well with applicants having a reduced credit rating.

End

New signing of your Bluewater Navy Act has taken alter to the newest Virtual assistant mortgage system. This type of transform improved the degree of homes possibilities for the daring someone in the uniform. Legislation enhances an already excellent bodies loan system by empowering individuals to the removal of Va financing restrictions.

Phil Georgiades ‘s the Specialized Rental Pro to have Va Home loan Stores, a government-backed brokerage concentrating on Va Home loans. He’s already been a real estate professional having twenty-two decades. To try to get a good Va mortgage, contact us on (877) 432-5626.

Have you got questions about your credit report? If you prefer to talk to a attorneys or borrowing advisors and done a no cost consultation please promote Borrowing Laws Center an out in 1-800-994-3070 we possibly may love the opportunity to let.

If you are aspiring to dispute and you will run their borrowing post on your own, here’s a connection that provide you with a few details on how best to go-about Do-it-yourself Credit Repair.