An important way that Borrowing Karma can make money is of the it comes visitors to loan providers. Having fun with Borrowing Karma’s mortgage marketplaces, you could evaluate credit cards, unsecured loans, automotive loans and much more. For those who start a credit card applicatoin for a financial loan off Borrowing from the bank Karma’s industries, Borrowing from the bank Karma will secure a percentage.

Complete, the financing Card industries had some very nice cards, but people who take a trip hack would-be disappointed by full range. If you’re only wanting an effective cards that have a low rate of interest or very good cash return possible, Borrowing Karma will help you to find the right card.

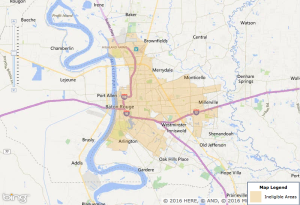

Property Suggestions

Certainly one of Borrowing Karma’s latest possess are a house to get area. Borrowing from the bank Karma allows profiles in order to input its money and deals in order to create a good property fuel estimator. This indicates the maximum amount you might feel approved having by using aside a home loan.

While it’s useful to select it, it is very important keep in mind that you need to put the finances when looking for a home. Within our circumstances, Credit Karma rates that people you can expect to hold a great $3200 monthly mortgage payment. However, while i imagine my child care will set you back in addition to undeniable fact that we pay money for our health insurance, this new $3200 try insanely highest.

Whilst the quotes are also nice, Borrowing from the bank Karma’s property cardio is still helpful. Users is discuss interest rates on the mortgages, and even sign up for mortgage pre-approval from just one out of Borrowing from the bank Karma’s lovers.

Higher Produce Offers

Credit Karma recently released Borrowing Karma Coupons – a premier give family savings who may have no minimums otherwise charges, and a leading level produce.

Immediately, Borrowing Karma Savings is offering 4.10% APY. One to throws it at the top of pricing your better urban centers to start a bank account.

The new account has no direct lenders for bad credit installment loans HI costs, zero monthly minimums, and that is FDIC insured around $5 mil due to a network out-of partner finance companies. The actual only real drawback is the fact this is a bona fide savings account, and thus withdrawals was simply for 6 moments a month.

Tax App

Borrowing Karma familiar with promote tax software, however, since it try acquired of the Intuit (the producer regarding TurboTax), it marketed their taxation thinking providers. You to company was renamed because Dollars App Taxes (you can read the money Application Taxation feedback here).

Although not, Credit Karma is the mate to have TurboTax due to their taxation reimburse cash loan this year. You should get your TurboTax mortgage delivered to a credit Karma money account.

Is actually Borrowing Karma Really Free?

Borrowing Karma is really 100% free to play with. Yet not, Borrowing Karma uses the platform to mention men and women to lenders. It earns a percentage whenever pages submit an application for a loan of the site.

It’s important to understand that Credit Karma spends monetary fitness since a means of purchases lending products. If you find yourself having difficulties financially, you actually should not submit an application for the latest handmade cards until you can consistently earn much more than just spent.

After you join Borrowing from the bank Karma, you give their personal cover matter, as well as your own credit suggestions. As soon as you go into you to definitely advice so you’re able to an online site, your improve the possibilities that you’ll be a sufferer from term thieves.

Regrettably, if you intend to operate inside construction of your progressive financial system, you will be susceptible to digital identity theft anyhow. Nobody is able to remain its pointers 100% secure. That being said, Credit Karma uses bank top protection as well as 128-portion suggestions encoding and read only usage of your details.

The actual question for many individuals is not whether its investigation is safe, but exactly how Credit Karma uses their recommendations. Borrowing Karma does not sell information, nonetheless use your financial research to help you highly recommend services and products to you. And you will they’ve recently acquired towards issues with the FTC around this habit.