In this article

- Procedures to Alternative Money

- Loan Options for Big Startups

- Loans Financial support versus. Security Financing

- Expert Q&An effective

- Financial support Tips to have Startups

Seemed Professional s

Huge records usually do not do just fine on their own. If you would like make a business that really stands the exam of energy, you need more a sensible tip and a strong works ethic: additionally you desire adequate financing. Whether you are hoping to function as 2nd YouTube otherwise pick a dining truck, this article has the benefit of insider advice on funding that will help you get the startup working.

Bootstrapping Their Startup Due to Choice Financing

Alternative investment choices have huge variations, regarding tapping into the coupons of having assistance from angel investors. Contrary to popular belief, lower than 1% of startups found investment capital financing, no less than within earliest degrees.

Here are some of your own solution financial support offer to look at because the you appear for getting your own idea up and running.

Personal Deals

If you have sufficient financing on your own savings account, it can be used to cover your own business pursuits. The benefit of this tactic is you need not remove a loan. However, if for example the team goes wrong, we offer debt funding so you’re able to fall off with-it.

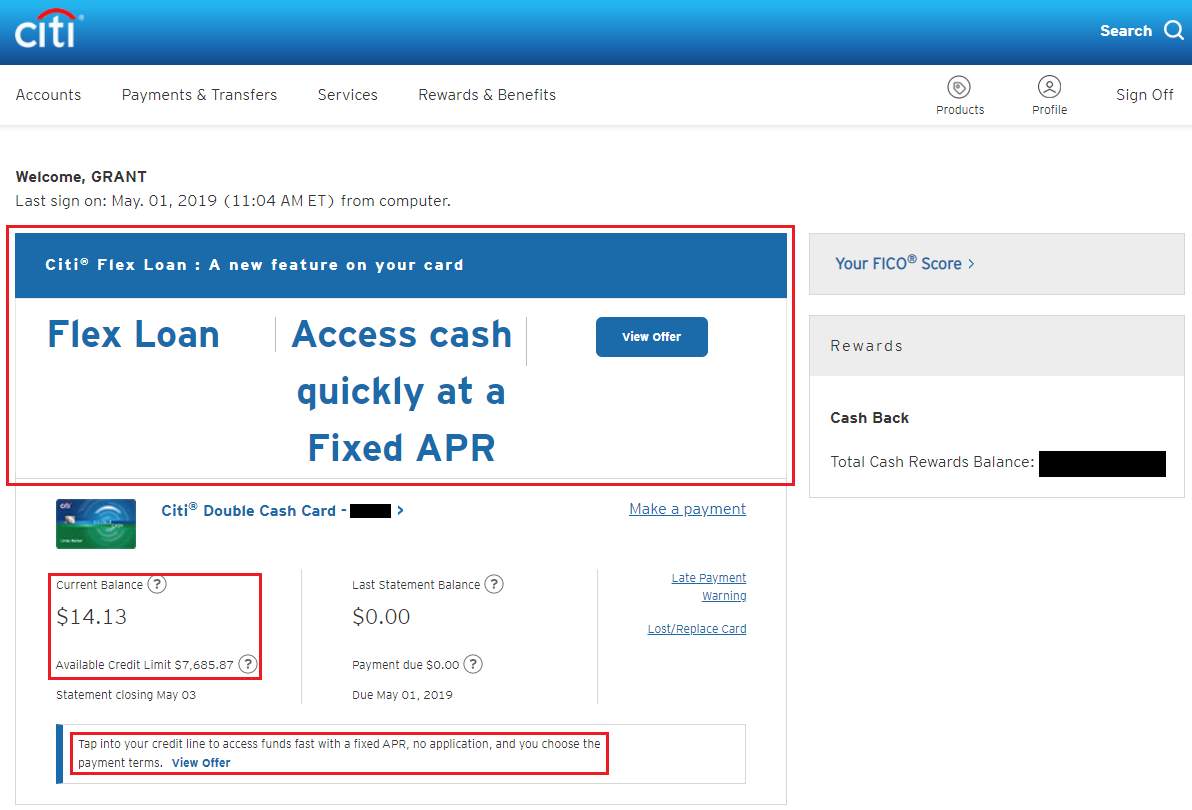

Team Credit cards

If you cannot qualify for a classic company loan, a corporate credit card try an intelligent option. Which have a business credit card, you could potentially secure your own versatile microloan. Might, however, need to privately ensure repayment and you may pay large interest levels. “I truly advise that you have made a business bank card alternatively of utilizing your credit, since it demonstrably delineates your company costs in the place of private expenses,” told you David Ehrenberg, creator and you can Chief executive officer from Very early Increases Economic Features, a San Jose-established company giving economic qualities and you will assist with individual strategy-supported startups.

Friends and family

With business loans hard to secure, capital out-of friends can be more easily offered. When your loved ones believe in your business campaign, they have been willing to loan you the finance you require. Just be sure to truly get your contract and you can payment package within the writing.

Stage Two: Increase your Community

If you cannot draw on individual deals along with your quick network, you may need to consider certain innovative the way to get become. Here are some a means to safe money beyond antique loans:

Grants

Certain small businesses qualify to own provides offered courtesy communities for example the little Business Government (SBA), even in the event standards shall be demanding. New SBA’s grant research equipment is also hook your having options you to definitely could work to suit your business.

Peer-to-Fellow Lending

Peer-to-fellow lending providers like Credit Club and Excel are very all the more common to have business owners and ambitious entrepreneurs which you should never safe money in other places. Using this type of type of borrowing from the bank, your bank comes with individual traders which loans your loan. You’re able to meet the requirements having less than perfect credit, but you will obtain a good interest and mortgage conditions in the event the their borrowing from the bank is better than average.

Microloans

Whether or not considering from SBA, a private local lender otherwise a government system, microloans can supply you with the newest hurry off investment you would like for various levels from providers progress. While you are microloans are generally for under $fifty,one hundred thousand, they can act as an effective lifeline for your business if covered during the right time.

Crowdfunding

Crowdfunding websites particularly Kickstarter and you will Fundable are helping business owners and startups get off the floor all around the nation. If you’re nearly anybody can submit an application for investment thanks to one of these strategies, a stronger record is generally expected to receive significant levels of investment. Understand that anybody can throw up a GoFundMe page; for people who truly want to begin compliment of crowdfunding, need a very good business plan to express.