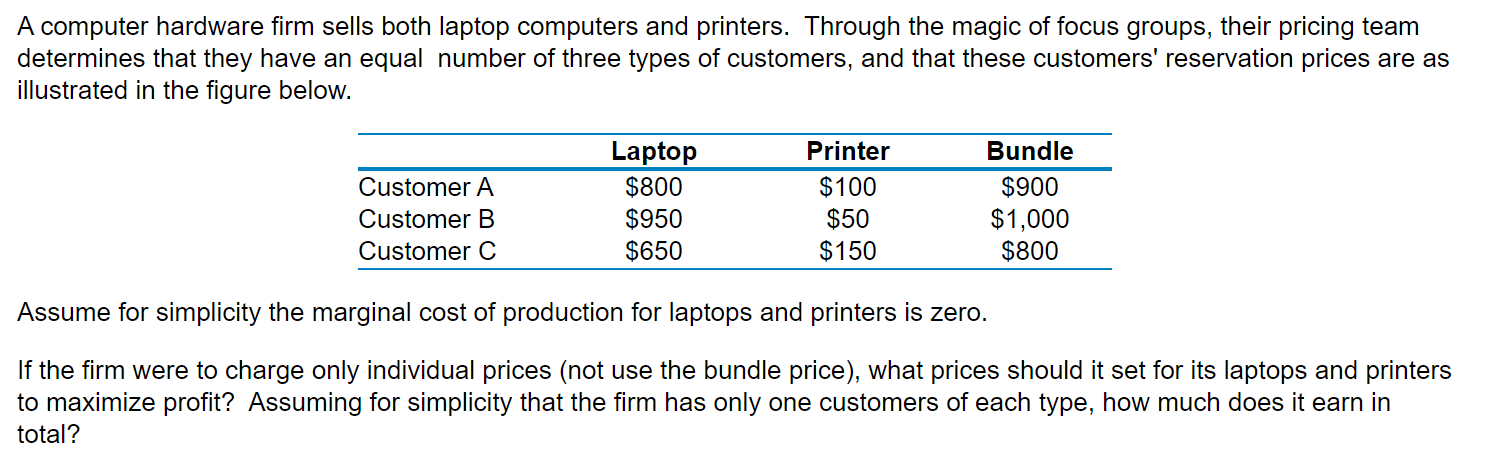

For most people, an excellent fifty% down-payment to the a mortgage actually a realistic choice. In case you may be promoting an earlier home with equity or has actually what is a co signer on a loan several other large source of cash, putting down half of an excellent residence’s price was achievable.

Imagine you happen to be willing and ready to build such a hefty off fee. Out-of a great lender’s viewpoint, chipping from inside the having a huge deposit allows you to more likely to blow right back the borrowed funds.

If you’re considering a painful loan provider to finance your property buy, a cost out of 50% off might even become a requirement. However, you really need to just do it having caution contained in this circumstances. Tough money loans usually element escalated payment conditions, highest interest levels, or any other terms which make him or her more pricey and you will more complicated so you’re able to pay back.

step 3. Reduce your loans-to-income proportion.

Various other component that influences what you can do so you can qualify for a home loan is the matchmaking within current costs plus money-otherwise the debt-to-earnings (DTI) proportion. Your own DTI ratio tells the lender how much cash spent compared into the number you get.

Generally speaking, the reduced their DTI proportion, the higher throughout the eyes regarding a loan provider. Including, you’ll be able to generally speaking you want a DTI from 50% or smaller if you would like pull out yet another domestic financing. Although not, the most DTI proportion a loan provider encourage may differ established for the financing particular and other factors.

The user Monetary Safeguards Agency (CFPB) recommends keeping your DTI ratio within 43% or reduced. In the event your DTI is higher than 43%, there can be a threat you’ll not be able to afford the loan, and you also could treat your residence in order to foreclosures afterwards.

cuatro. Imagine bringing an excellent co-signer.

Adding the second title so you can a loan is a technique one those with bad credit are able to use to boost acceptance chances whenever making an application for capital. Towards the home financing, there are 2 a method to incorporate various other team for the financing app. You can a good co-debtor or a great co-signer.

- A good co-borrower on home financing, also referred to as a joint debtor, offers possession of the house and monetary responsibility to repay the fresh mortgage.

- Good co-signer into a mortgage is actually a low-occupant whose term cannot show up on the new deed. They don’t individually take advantage of the mortgage, but they display economic liability toward debt.

Adding a co-borrower or co-signer with a good credit score to the financial can help the lender become much warmer providing the borrowed funds. On top of that, having a moment borrower which have good credit results decrease the new lender’s chance simply because they features a creditworthy team to follow in case there are a default.

In addition, you might be inquiring a lot from your own family relations, especially if they won’t live in our home and you can probably gain benefit from the capital. At the same time, Co-consumers and you will co-signers are merely because accountable for the debt since number 1 borrower.

The borrowed funds may show up on the co-signer or co-borrower’s credit reports as well. So, people later payments towards loan you will definitely wreck the credit ratings. Also, even if you constantly shell out on time, the additional loans escalates the DTI proportion for your co-signer. That could enable it to be burdensome for them to borrow cash again once they need to later.

5. Rate shop.

It is usually best if you contrast has the benefit of out-of multiple loan providers one which just remove another type of loan. But rates hunting benefits is actually most obvious when it comes to mortgages. If you’re given taking out fully a top-rates financial on account of credit pressures, the requirement to examine numerous also provides is also much more essential.