Leasing Earnings: The potential rental income about extra gadgets are going to be factored for the borrower’s degree techniques, delivering an opportunity having meeting income standards.

Provided a keen FHA financing on acquisition of a beneficial multifamily possessions which have around five tools? It is an intelligent disperse, however, like any financial choice, weighing the pros and you will cons is a must.

Easier Recognition: FHA financing, backed by the newest U.S. authorities, render a smoother approval procedure. Lenders may give money to individuals which have prior borrowing from the bank demands, while making homeownership offered to a wider listing of customers.

Lower Credit history Requirements: FHA loans provides a comparatively lower credit rating needs, with a minimum of 580 if not as little as 500 which have a good ten% downpayment. This is certainly a beneficial stark contrast to your typical 620 credit history importance of old-fashioned financing.

Limited Advance payment: One of many standout advantages is the low down commission requisite out of simply step three.5%. Concurrently, some state construction financing firms provide down payment guidelines software, after that reducing the initial prices.

Available to The Individuals: In place of specific financing items with specific qualifications conditions (age.g., armed forces service to have Va finance otherwise rural place for USDA loans), FHA money try offered to all loans in Altona borrowers. Whether you’re eyeing a house in the heart of the metropolis or a rural oasis, FHA money are inclusive.

Mortgage Advanced (MIP): FHA loans have MIP, comprising an initial fee and continuing annual premium. While it advances financing usage of, they increases the long-identity borrowing pricing.

Stringent Assessment Techniques: FHA funds demand the application of FHA-accepted appraisers, which is a challenge discover. Also, FHA assessment requirements are far more rigorous compared to traditional loans. This guarantees assets high quality but can bring about a very extensive assessment processes.

Ought i Use Local rental Earnings to Be eligible for an FHA Multifamily Loan?

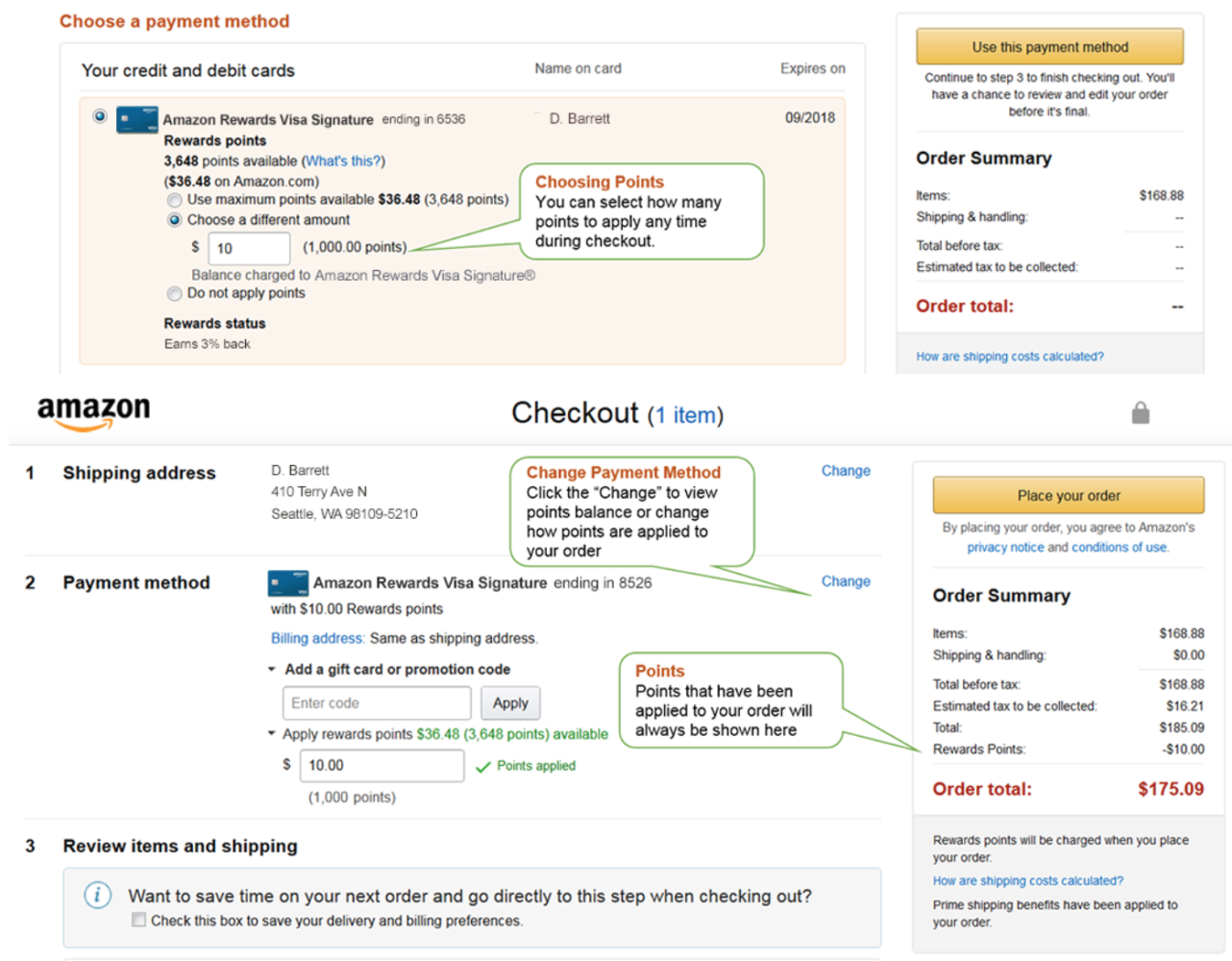

Regarding a keen FHA multifamily mortgage for a property which have several devices, its required to know how rental money can be used to be considered, specifically if you lack a serious local rental records on assets. Here’s how it truly does work:

For people who already have rent preparations set up into the property, you could potentially promote them to the lender. These apartments act as evidence of coming rental income. It is required to show these types of agreements as they possibly can enjoy a good important role in the proving the fresh property’s money potential.

If perhaps there is no need current lease preparations, the lender commonly generally speaking purchase an equivalent lease schedule as an ingredient of the home assessment process. An appraiser commonly estimate industry lease for each equipment within the house or property.

To determine exactly how much leasing earnings you need in order to be considered on the FHA multifamily financing, you are able to generally make use of the smaller of several solutions:

FHA Duplex, Triplex & Fourplex Advice

- Earnings Based on Profit and loss Declaration: If provided with the latest appraiser (commonly having fun with forms particularly Federal national mortgage association Mode 216 or Freddie Mac Means 998), you can make use of the new local rental earnings based on the property’s funds and you can losings statement. Which statement situations in numerous doing work expenditures and you may revenue, offering an intensive view of the fresh new property’s income prospective.

FHA Duplex, Triplex & Fourplex Direction

- 75% regarding Reasonable Market Rents or Actual Rents: Alternatively, you can utilize 75% of fair field rents (normally determined by the new appraiser) or even the real rents, any kind of is leaner. Which ensures that you may be having fun with an old-fashioned guess out of leasing income getting qualification objectives.

Let’s consider an example: This new appraiser estimates one a unit you will definitely book to have $1,000 a month, and it’s already rented at $800. In such a case, you can utilize 75% of the actual lease, that’s $600, getting degree objectives.