Conforming financing constraints rose to help you $647,2 hundred having unmarried-equipment residential property into the 2022, symbolizing an 18% increase-a typically high jump for the seasons-over-season loan limits. Here’s what you should know on what you to definitely boost you will definitely imply to you personally-and you may a robust solution available if you don’t qualify.

Do you know the compliant financing limits to own 2022?

The total amount you might acquire with a conforming mortgage, commonly referred to as an everyday financial, is actually adjusted from year to year by Federal Houses Finance Service (FHFA). Round the all of the You within the 2022, new borrowing limit to have just one-tool house is doing $647,2 hundred, during pricier parts of the us, such as for instance Their state, Alaska, the us Virgin Countries, and you can Guam, the latest credit limit are closer to $970,800. Those borrowing from the bank limitations rose once the 2021 in the event the borrowing limit towards the a single-product domestic in the most common components of the united states was $548,250 and in those individuals costlier regions try doing $822,375.

While these types of rates portray the new borrowing restrictions getting single-product residential property, it needs to be indexed to also obtain more cash for two-product, three-device, and/otherwise four-unit homes.

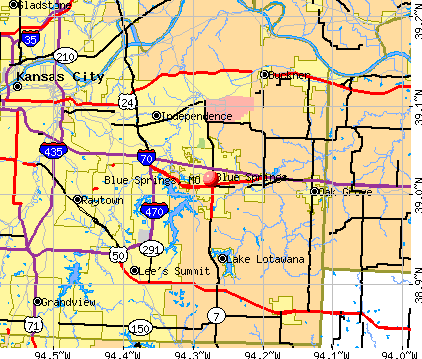

How much certainly are the conforming loan limitations for every county?

The Federal Construction Loans Agency’s 2022 conforming mortgage restrictions improve in order to $647,two hundred for the majority places in america is a growth regarding 18%-the largest 12 months-over-seasons mortgage limit leap inside recent thoughts. If you’re good transferee hoping to move in, and also you need some additional to purchase power, that it development is extremely helpful.

To track disparities during the casing affordability and imagine mortgage defaults part by the area, the fresh new FHFA enjoys recognized large-rates places where financing constraints have risen to accommodate the new extreme cost of a property. In every identified highest-pricing parts, the new median household well worth is more than the fresh standard compliant mortgage limit. The particular compliant financing limitation can be large as the 150% of one’s standard compliant loan maximum, according to average family really worth in the region.

Getting review, here are conforming mortgage constraints out of biggest centres during the four various other says. Inside the Detroit, Michigan, the newest compliant loan limit sits at the $647,two hundred. The fresh compliant mortgage limitation increases so you’re able to $694,600 from inside the Nashville, Tennessee. In the San diego, California, meanwhile, new compliant financing restrict is actually $897 cash advance usa in Cottonwood,750 plus Jersey City, New jersey, the mortgage restrict can be as much higher in the $970,800.

Unique consideration is and additionally supplied to this new low-contiguous states and you will territories such Their state, Alaska, the united states Virgin Countries, and you will Guam, where from inside the 2022 the newest FHFA’s conforming loan maximum consist within $970,800.

Compliant financing vs jumbo finance

An effective jumbo financing is advisable if you need so you’re able to use over FHFA have anticipate in the 2022. This basically means, jumbo financing try mortgage loans for anyone demanding more substantial mortgage than just the latest FHFA constantly lets, and you will, compared to the conforming financing, normally have highest rates and you will stricter requirements. And since jumbo funds bring a top exposure to own loan providers, businesses make qualifying harder to decrease the likelihood you to definitely an effective borrower often default for the one repayments.

When you find yourself loan providers possess their conditions to have jumbo financing, you will likely you need a reduced loans-to-money proportion, increased credit score, and you can a larger advance payment compared to conforming loans. A credit score with a minimum of 700 and you can good 20% or more deposit can be required. A loans-to-earnings ratio from ranging from 36-45% will in addition be required. The greater the debt-to-earnings ratio, your down-payment, along with your credit rating, the more likely you are discover acceptance to have a beneficial jumbo financing.

If, in addition, your debt users plus credit rating are too weakened having a conforming loan otherwise a beneficial jumbo mortgage, you can get a keen FHA financial, which is ideal for those who have an obligations-to-earnings proportion lower than 43% and you will a credit rating as little as 580.

If you are an army representative, or you are to order a house into the an outlying part, you could choose a good Virtual assistant financial. You do not need a down-payment for sometimes of your home loan models. USDA mortgages often have a similar restrictions since conforming loans and Virtual assistant mortgage loans don’t have borrowing from the bank constraints.

Transferees has actually a higher danger of to buy a home

Because the conforming loans provide reduce percentage solutions and you can competitive mortgage rates, transferees gets a top threat of buying a home. Because a great transferee, you are able to grow your search into the increased-stop housing industry with an increase of possibilities, and less be concerned, compliment of much more readily available spending strength much less due at the closing dining table.

Transferees just who otherwise could have been cost outside of the industry will likely be able to expand the research standards, potentially protecting a special assets on new-year.