A little more about financial people hold specific level of cryptocurrency. Bitcoin is the most prominent, however, many other styles exists. However,, create banks consider these possessions? It all depends. Already, extremely lenders dont envision cryptocurrencies given that possessions within latest form. With the high price volatility, very lenders simply never evaluate her or him given that credible enough to are inside the a home loan app. However,, if you would like increase your requisite property, you might offer the cryptocurrency holdings.

As an example, state you possess Bitcoin already valued within $50,000. For those who sell these types of holdings and you will convert them to cash, lenders tend to admit the money just like the a secured asset to your web worthy of. Up coming, for people who therefore notice, you can repurchase your own holdings in the the fresh worth after you personal in your mortgage.

NOTE: Such conversion process can produce capital development taxation, so make sure you speak with a tax elite prior to selling people cryptocurrency.

Other Home

Second, finance companies may wish to know about other real estate you possess (elizabeth.grams. a vacation house or rental functions). In the place of holds and you will bonds, this type of property cannot be quickly ended up selling to cover home loan repayments. However,, for many who own more a residential property, you could realistically sell to keep latest on your loan.

Additionally, exhibiting most other a home in your house listing brings a supplementary benefit: this means you proven on your own a professional borrower together with other mortgage loans. This can ultimately think on your credit rating, but it addittionally helps to demonstrate to loan providers you have effectively signed on the and you will existed latest into another financial.

Security into the an individually Stored Company

Finally, you need to divulge people control or security you hold www.paydayloanalabama.com/maplesville/ in the an actually held company (i.e. a buddies that does not trade offers into the a general public stock-exchange). Using their individual nature, attempting to sell these types of guarantee bet can be quite tricky, if not outright taboo by corporate agreements. However,, it security means an asset nevertheless. And you can, into the a poor-instance circumstance, consumers could potentially select an effective way to convert this guarantee into the dollars and work out home loan repayments.

An email on the House Confirmation

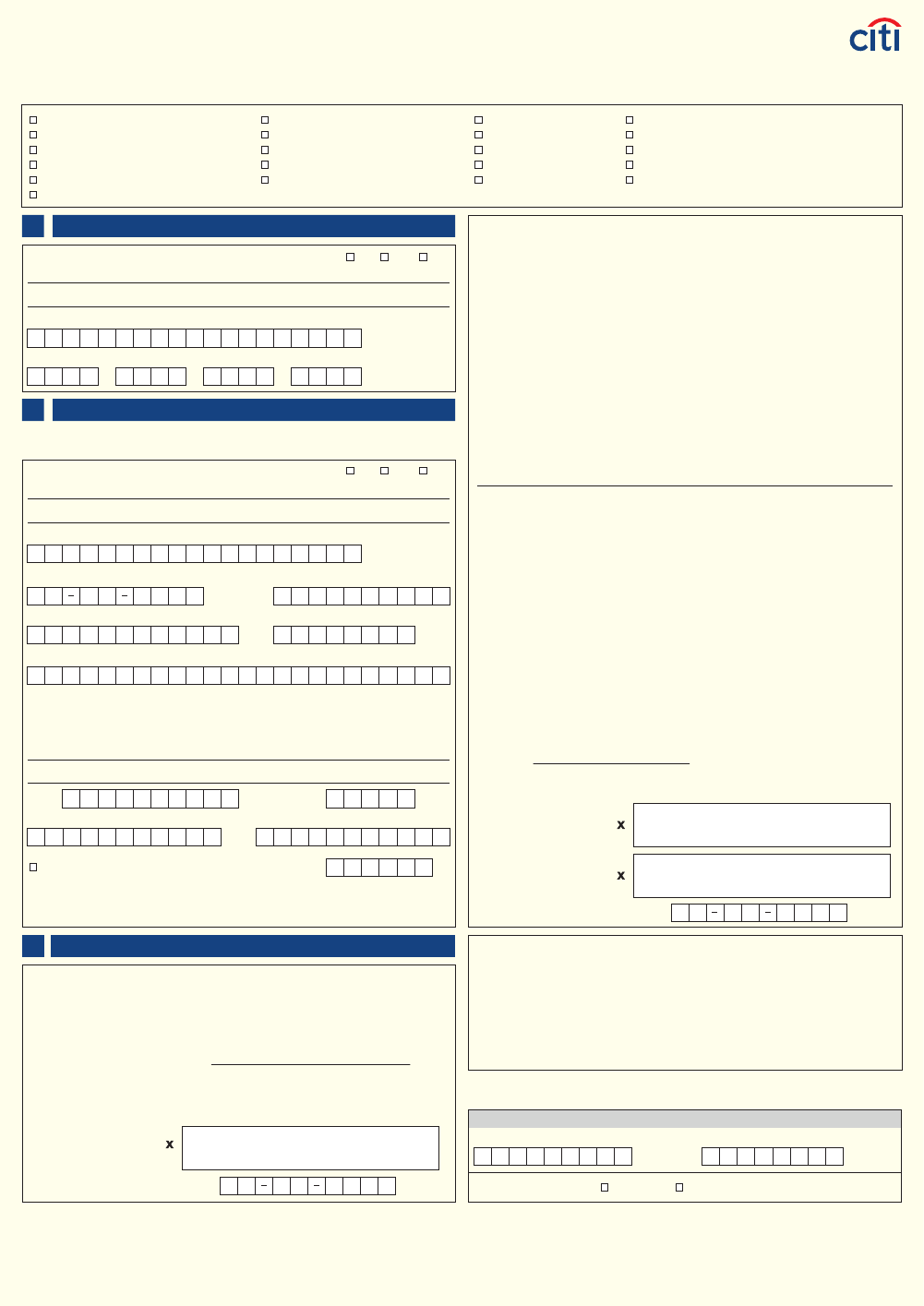

When borrowers done their very first home loan software, they are going to worry about-declaration all significantly more than possessions. Into the financing underwriting techniques, loan providers should indeed verify these possessions.

For money, liquid assets, and you may advancing years accounts this can generally include entry your newest membership comments. Cryptocurrencies will most likely must be changed into cash, with loan providers seeing an account statement reflecting that money balance. Real estate confirmation generally comes with a deed off title and you may relevant mortgage feedback. Ultimately, verifying stakes in the myself stored people will vary based on organization form of. We offer banking institutions to ask getting providers doing work preparations, stockholder licenses, corporate charters, or any other documents they deem needed to ensure your possession.

Normally, loan providers rank possessions of most so you’re able to minimum liquid. That is, dollars and money equivalents certainly are the essential, because consumers normally very effortlessly make use of these money and also make mortgage payments. For the a difficult disease (elizabeth.grams. scientific crisis, business loss, etcetera.), you might rapidly tap these types of accounts to stay most recent on your own loan.

Because you flow along the above record on the less liquid assets, lenders will likely assign shorter lbs. And their characteristics, illiquid assets establish much harder to use from inside the a great bind. While you are borrowers are selling a vacation home to shelter mortgage payments toward an initial house, this may probably simply take a long time period.

Summary

No matter how a lender measures personal assets, borrowers will be have a look at reporting these things since the a-is-most readily useful process. Generally, the greater number of possessions you have, the larger your own online really worth. And you can, the bigger their web really worth, the reduced your own risk so you’re able to a loan provider in spite of how style of possessions were the majority of you to websites value. So it straight down risk develops your odds of one another 1) mortgage app recognition, and 2) significantly more useful loan terminology.