From capitalizing on a lower payment per month in order to ditching the FHA financial insurance coverage, there are many reason why you might re-finance.

But exactly how far in the event that you expect to pay? Let us have a look at average price of good re-finance and you may what you you will anticipate paying for every single of one’s settlement costs.

Finest Urban centers to help you Refinance:

- Greatest Full: Quicken Fund

- Good for Mind-Operating Borrowers: The brand new American Money

- Good for Convenience: Reliable

- Ideal for In-People Services: Wells Fargo

- Greatest Towns so you’re able to Refinance:

- Re-finance Charges Said

- Best Lenders getting Refinancing

- Re-finance the proper way

- Faq’s

Re-finance Charges Explained

Identical to should you get home financing, you will have to pay a number of will cost you during the closure whenever you refinance a home loan. The will set you back you can spend and you see this here will fees you are able to deal with are different dependent on their re-finance solutions and you will in your geographical area. As a general rule, could pay 2% to 3% of one’s total worth of the loan after you re-finance.

Why don’t we look at probably the most preferred refinancing settlement costs, the common price of per item and just what for every single payment covers.

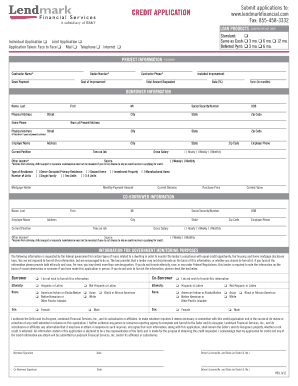

Application Percentage

Before you could located a choice on your re-finance, your financial often costs your into the cost of processing your application. The application fee usually discusses the cost of a credit check and you will a keen underwriting investigation of your financial advice your fill in that have your own re-finance. Among the better refinance mortgage companies enjoys got rid of the application fee, but the majority lenders still fees them in some skill.

Expect to pay from the $200 for the refinance application fee in case your lender charges 1. Understand that this percentage is due even if you commonly approved to possess good re-finance, so make sure you see your brand new lender’s requirements before you apply.

Assessment Payment

An appraisal is a professional estimate of your own sum of money your home is worth. During an assessment, property really worth professional titled an appraiser needs a stroll up to your property, do a little external look and you may designate an esteem to your residence.

Loan providers want a unique appraisal on most refinances. The reason being they should be certain that your home really worth have not fallen as you ordered your home.

Not every particular re-finance demands an appraisal. In the event your lender need you to get a new appraisal, you can expect to shell out about $five-hundred for this percentage.

Label Insurance rates and search

Term insurance is a variety of safety one to coverage both you as well as your bank of fighting states towards possessions you will be to invest in. During a subject search, a subject insurance carrier have a tendency to research the reputation of the house or property to ensure that you do not have liens or says to the the property that will avoid the financial off taking on it in the event that you standard in your home loan.

Once you re-finance with a new financial, it is possible to always need to pay for the next label browse and you may term insurance plan. Brand new title look and insurance techniques typically costs a total of from the $900. Thankfully you to definitely, unlike other types of insurance rates, it’s not necessary to pay for term insurance policies per month – once you pay it off after within closing, you’re secure so long as you may have your loan.

Loan Origination Payment

Your loan origination fee is usually the most significant expense you are able to pay after you re-finance your financial. The borrowed funds origination payment compensates their financial to have drawing in the files for your loan, calculating your own interest and arranging the checks and appraisals you can easily you desire before you can personal your own refinance.

You can’t really lay an exact dollars guess into the loan origination percentage since the majority loan providers cost you a set fee fee in line with the value of the loan. Typically, anticipate paying about step one% of one’s complete value of your loan. For example, whenever you are refinancing a beneficial $200,one hundred thousand mortgage, you are able to generally spend around $2,000 into the a loan origination payment.

Attorneys Fees

In certain states, attorneys must opinion and agree mortgage papers before you sign away from on the refinance. They require to examine the loan agreement to be sure so it contains zero illegal conditions which the financial enjoys correctly calculated your own charges and you can rates of interest. A legal professional also can need to be expose within closing desk to ensure your own refinance.

Better Lenders getting Refinancing

Now that you recognize how far it can cost you to refinance, let us evaluate the best metropolitan areas so you can re-finance an interest rate.

1. Most readily useful Full: Quicken Fund

If you are searching for an easily means to fix re-finance nearly any sort of mortgage loan, Quicken Funds will always function as correct one for you. The business enjoys streamlined the fresh new re-finance techniques – you can now over the application on the mobile otherwise tablet and discovered a decision within a few minutes.

Quicken Financing focuses primarily on taking numerous refinancing choice. Of FHA streamlines in order to jumbo bucks-away refinances, their people does it the. That have an easy-to-discover procedure and plenty of suggestions available, Quicken Funds is the very first choices with respect to the newest finest refinance loan organizations.