- Upsizing blank-nester fantasizing regarding acres so you can wander

- Downsizing zoom towner happy to take a trip

- Multi-generational genius having recovery ideas aplenty

While an initial-day homebuyer, begin here. In case it is been some time as you strolled the house-to get process, be confident. This informative guide covers owning a home styles, how-to best size, and various loan versions. There is also a beneficial refresher with the steps in the fresh homebuying procedure.

Rightsizing for life’s goals

Life milestones results in large change. ily, altering perform, retiring. People situations are a great time for you wonder: Do my personal current family still take a look at boxes I want they in order to? If this doesn’t, it may be time to rightsize.

- Just how many room – bed rooms, organizations, popular parts, restrooms – do you really need?

- Could you spend more go out outside the house compared to it?

- Does the house hold positive or negative memories?

- Was anyone happy and ready to manage repair into lawn, pool, otherwise store?

- Do multi-levels assist the ones you love vibrant, or will they be a risk?

Continue that top next household in your mind since you beginning to arrange for simple tips to go it – in addition to delivering a home loan.

Very few loan providers ensure it is property owners so you can transfer an existing home loan so you’re able to a new house. That implies you will need to look at the mortgage techniques again. One lender – Numerica provided – wants to make sure you be able to undertake mortgage debt. On Numerica, we spouse to you by researching all the home loan applications to the 5 C’s:

- Character: Your credit history, a position records, long-label economic wants, plus full experience of Numerica

Numerica suits people – not just individuals with primary fico scores. I work on insights you and the way you manage your currency. I as well as build lending decisions in your area as well as on just one base.

See mortgage possibilities

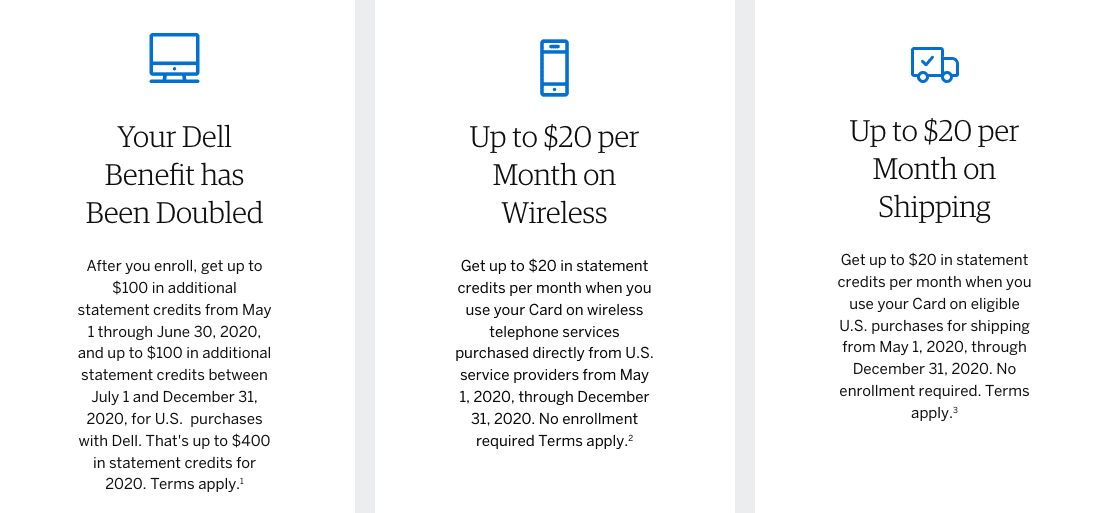

There are plenty of loan possibilities, it can feel like a great deal. Listed below are some of one’s special properties of the house funds offered by Numerica.

Numerica’s Financial Cluster consists of positives for the all the of those choices. Contact these to mention your targets and also the correct financing for your situation.

Refresher way: 5-action homebuying processes

Happy to dive into homebuying process making your future house possible? For the positive information, it most likely has not yet changed much because you purchased the first domestic. You should get your funds manageable, discover what you can afford, apply for financing, shop for a home, making the give.

Tell the truth about what you will be comfy shelling out for your following home. Usually other people assistance with the borrowed funds for the a multi-generational home? Have you got more money at your fingertips now that the newest students have gone? Plus cause for extra costs that include every home buy. Settlement costs can vary from three to six percent of one’s new house’s complete cost. They might be loan origination costs, domestic inspection reports, plus.

Expert tip 2: Of several lenders allow out of 4-6 mortgage co-candidates. If you are going the newest multiple-generational domestic route, this might help. An effective co-applicant’s income ount. However, all of the co-individuals is accountable for mortgage fees if the number 1 applicant defaults.

Expert tip americash loans Slana step three: Don’t want to discover prescreened also offers out-of borrowing from the bank otherwise insurance coverage? You could register on optoutprescreen to decide away of also offers you to definitely weren’t specifically asked from you.

Seeking the next home is just as fascinating just like the shopping to suit your earliest house. Consult home-browse websites. Manage a real estate agent to incorporate postings that fit your position. Realtors usually have early accessibility new postings and can remove comparable property in the area.

Pro suggestion: Specific Real estate agents may offer a lower fee if you are using them on your home get and you can household purchases. This enjoys more cash in your wallet.

The deal stage movements timely. A representative makes it possible to navigate contracts, restrict also provides, and you may deals. For many who individual a current domestic, you’ll need to ple, you age to help you sell the house you might be located in before you can disperse.

Numerica: lenders each stage out of lifestyle

This post is provided for educational intentions only that is maybe not designed to alter the recommendations from a financial mentor, mortgage user, or similar top-notch. The advice given into the blog post try such as for example just and you may will most likely not apply at your situation. Since the all the problem is different, i encourage speaking-to a professional your believe concerning your particular means.