Nowadays, home prices have fell into an excellent tailspin to own countless active obligations armed forces users, nearly all exactly who have gone underwater on the mortgage. This means it are obligated to http://www.paydayloanalabama.com/elberta/ pay more on the home loan than the fresh field dictates the value of our home isplicating this problem having armed forces home owners ‘s the growing odds of choosing Long lasting Alter regarding Channel Commands .

An owner as opposed to equity may be forced to survive a long time waits at home income, Personal computers sales negate this luxury. Minimal equity is actually let me make it clear unfavorable having veterans wanting easily promoting their house; however it is imperative to remember all of the home is going to be offered, actually those people in the place of collateral.

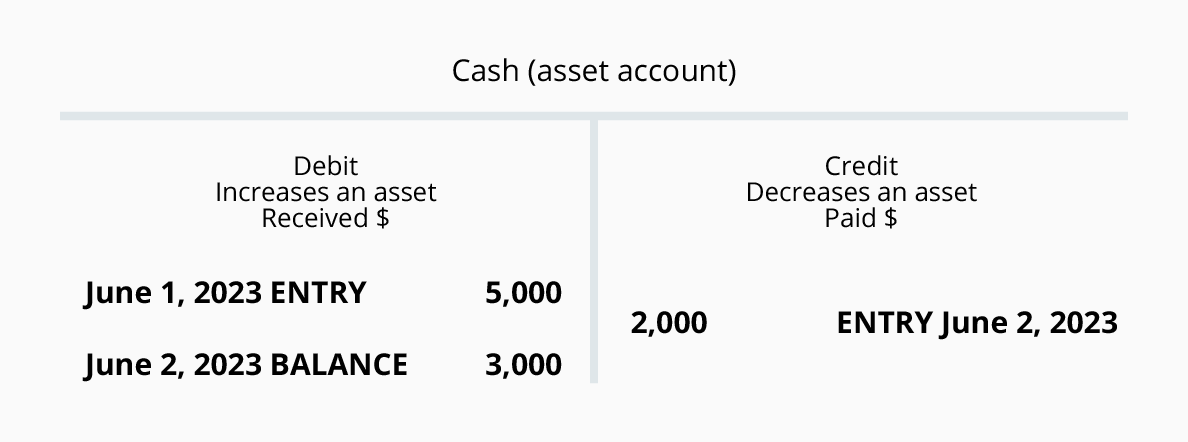

Immediately following deducting the latest owners’ outstanding harmony to their mortgage in the market price already analyzed from the good valuator, home guarantee is decided while the sum of money left-over. Because financial obligation try paid down, household equity rises. On top of that, guarantee develops when an effective residence’s value appreciates.

Va Home loan Facilities possess obtained a list of five alternatives one to under-equity army players keeps when they need sell their residence.

Military people and you may veterans who are under water and need to sell their home don’t have any most useful services than just a compromise sale. Referred to as a primary sale, it purchase occurs when the particular owner and you can bank commit to promote the house for less than what’s due.

A short deals is more good than a property foreclosure; it does carry out a lot less in order to damage your own borrowing from the bank and coming ability to buy a consequent house.

The fresh Company off Experts Products lets veterans to be eligible for a great Va loan adopting the an initial selling. To own veterans and you can energetic obligation group wanting a short profit , think of, Va Home loan Locations HAP military brief purchases reduction program try designed to let citizens who require to market land with reduced property value than simply home loan equilibrium. This choice is offered at no with your own money pricing in order to qualified candidates. Va Mortgage Locations commonly aggressively sector the home; where compatible render closure prices credit or any other bonuses to aid secure a buyer. VAHLC will provide symbol toward supplier once they perform n’t have a representative.

Though there is no telling just how long brand new small purchases process last, VAHLC is going to do everything we can be so you’re able to expedite the process. Just after interested in a purchaser, it will take 31 so you can two months to receive recognition right after which an additional 31 to close off.

Many useful solution to the latest test away from selling a good household in place of security is to get good representative. Having fun with a professional who can aggressively pursue people, and you will speed the home right is incredibly important. The very best challenge to own vendors, within the choosing a real estate agent, was related charges reducing into currently slim offering items. The lower conversion rate together with the cost of paying down the loan is troublesome for the majority.

Some representatives have a tendency to inquire about up to half dozen percent from inside the percentage related charges. This can substantially reduce steadily the payouts of one’s revenue.

However, Va Home loan Centers offers assistance to underwater pros as opposed to away regarding pouch charge if they’re brief selling a house.

While we advise that suppliers have fun with agencies, many veterans is experienced sufficient to promote without any help of an agent. If a purchaser is in-line hiring legal counsel so you’re able to deal with, new files would be a life threatening discount with the merchant. Experts who will be working without a real estate agent need certainly to rate its household accurately, decorate the house, effortlessly sector your house and get your house inspected.

Pros rather than security who are quick on time after the a pcs can often offer their property quickly in order to a trader otherwise capital group. A lot of companies are prepared to purchase property that have restricted collateral if owner lowers their asking price.

Even although you take on that it provide and make use of all of our provider, your lender might not agree to alter the terms of their mortgage along with approving your own small product sales

Like funding communities, national i purchase homes organizations are working with manufacturers looking to clear the home quickly. Providing quick cash in order to hopeless people trying to get their house off the field, these types of deals happens instead Realtors, representatives and you may brokers. The danger associated with the are attempting to sell to have well using your asking rate and you can market price. If you’re trying to find this 1, make fully sure you get a good assessment.

Whether or not offering your home if this does not have collateral was overwhelming, it is very important continue to be confident. There is no including procedure due to the fact property that can’t getting offered. For many who already are obligated to pay more than exacltly what the house is really worth contact Va Home loan Centers within 877-573-4496 to discuss the choices.

Important Notice:

If you choose to enjoys Va Financial Centers handle your case within the offering your residence as the a preliminary marketing, you could end playing with all of our features at any time. Virtual assistant Mortgage Facilities fees zero up-front fees to help you together with your short revenue. Our mate home brokerages usually fees a bona-fide home commission however bank agrees to help you a preliminary sale, this is exactly purchased by your bank. Va Home loan Stores isnt associated with regulators, and our very own provider is not approved by the regulators otherwise your own lender. It is recommended that you continue to create money on the mortgage on process. Should you standard on your money, you can view a poor perception into the credit report and you can your home could be foreclosed upon.